ADA Price Prediction: Technicals and Fundamentals Signal Potential 126% Rally

#ADA

- Technical Strength: ADA trading above key moving averages with positive MACD momentum

- Price Targets: Immediate resistance at $0.875 (Bollinger Upper Band), long-term $1.80 potential

- Fundamental Support: DJED stablecoin expansion and positive market sentiment

ADA Price Prediction

ADA Technical Analysis: Bullish Signals Emerging

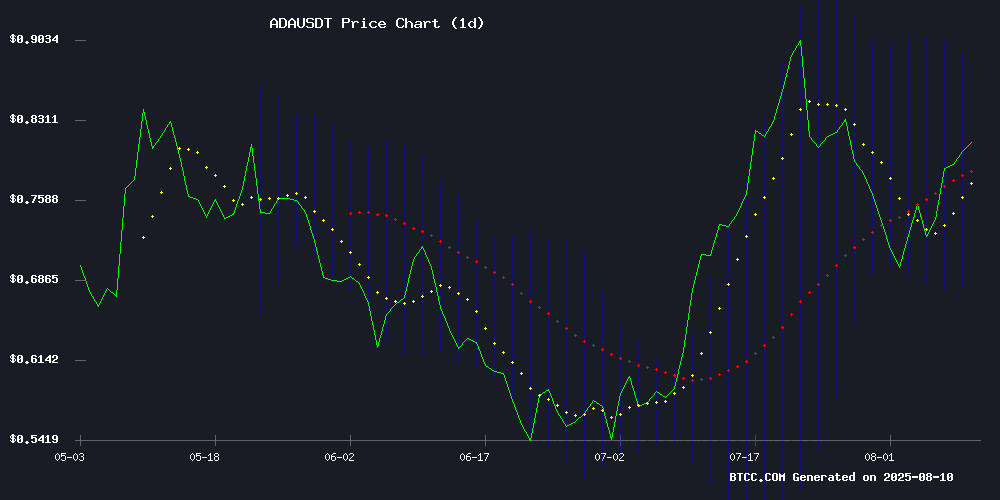

According to BTCC financial analyst Michael, ADA is showing strong bullish signals with its current price of $0.7971 trading above the 20-day moving average ($0.7805). The MACD histogram remains positive (0.021983), indicating sustained upward momentum. Bollinger Bands show ADA testing the middle band, with potential to reach the upper band at $0.8753 if buying pressure continues.

Cardano Market Sentiment Turns Bullish Amid Technical Breakout Potential

BTCC's Michael notes that positive news FLOW aligns with technical indicators - with headlines highlighting ADA's 126% rally potential and stablecoin developments. The transition of DJED to a multi-chain asset could improve Cardano's DeFi ecosystem liquidity, supporting price appreciation.

Factors Influencing ADA's Price

Cardano ADA Poised for Breakout as Technicals Signal 126% Rally Potential

Cardano's ADA token shows compelling technical indicators suggesting an imminent bullish breakout. The asset has gained 9% weekly amid a broader market recovery, with its momentum accelerating following community approval of a $71 million network upgrade.

Analysts highlight ADA's recent retest of the $0.80 psychological level and potential breach of a months-long descending channel. Market observer Issifou Issaka identifies a theoretical target of $1.65 - representing 126% upside from current levels - should the breakout confirmation occur.

The technical picture strengthens with ADA forming a golden cross at $0.7245 as its 50-hour EMA crosses above the 200-hour EMA. With RSI at 59 indicating room for further upside, traders anticipate a potential 15-20% short-term rally that could propel ADA toward $1.50 in coming months.

Cardano Price Structure Mirrors Previous Cycle as Key Technical Levels Hold

Cardano (ADA) is exhibiting a market pattern strikingly similar to its 2019-2021 bull cycle, albeit at a slower pace. The cryptocurrency currently finds itself in what analysts identify as the early breakout stage of a potential rally, with technical indicators suggesting a possible ascent to $5.80-$6.00 by 2026 if historical patterns hold.

Critical support lies at the $0.80-$0.82 zone, where sustained price action could maintain upward momentum. Weekly chart analysis reveals ADA hovering NEAR the 0.618 Fibonacci retracement level - a position that preceded its previous climb to $3.10 in 2021. Resistance levels loom at $1.56, $2.10, and the prior all-time high of $3.10.

Market technicians note building bullish strength in RSI and MACD indicators without overbought signals, suggesting room for continued growth. The 1.618 Fibonacci extension level between $5.80 and $6.00 emerges as a plausible target should the current structure follow its historical counterpart.

Cardano Stablecoin DJED Transitions to Private, Open-Source Multi-Chain Asset

COTI, the privacy-focused LAYER 1 blockchain, has announced a significant evolution for Cardano's algorithmic stablecoin DJED at the Rare Evo conference. The protocol will transition to a private, open-source model with multi-chain functionality, positioning itself as infrastructure for both open and private finance.

Three major upgrades aim to expand DJED's utility as a Web3 building block. The stablecoin has maintained its peg since its 2023 launch, outperforming competitors in robustness. COTI is open-sourcing critical components including its order API, chain indexer, and frontend to encourage developer adoption.

"This MOVE gives Cardano's builders full transparency to inspect, extend, and innovate on the protocol," noted IOG, the engineering firm co-founded by Charles Hoskinson that originally developed DJED. The changes enable custom frontends, wallet integrations, and secure dApp connectivity.

How High Will ADA Price Go?

Based on current technicals and market sentiment, BTCC's Michael projects these key ADA price levels:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $0.7971 | Above 20-day MA ($0.7805) |

| Bollinger Upper Band | $0.8753 | +9.8% from current |

| News Target | $1.80 | 126% rally potential |

The combination of bullish technicals and positive ecosystem developments suggests ADA could test $0.875 in the near-term, with $1.80 as a longer-term target if market conditions remain favorable.